In microfinance or a Sacco, dividend is the sum of money that you pay regularly to your members out of your profits or reserves.

You may pay dividends monthly, quarterly, semi-annually, or annually depending on the policy that you’ve set in your Sacco. However, in most cases, dividends are paid out only once a year during the Annual General Meeting(AGM).

In other words, a dividend is like a share of profit that you give to the members of a Sacco to encourage them to save and invest their money.

Today 23rd march 2021 MNS held it’s 42nd Annual Deletes Meeting at Bomas of Kenya.

We wish to inform you of the following resolutions that were passed during the ADM.

1. Rebates to be paid at 9.3%

No dividends pay out to enable the sacco move towards meeting the core capital ratios as required by the regulator.

2. The share capital has been moved from previous ksh. 20 000 to ksh 30 000 in 2 years of ksh 5 000 each year . This is to meet the SASRA requirements of 10%.

3. Members who used the 5% PAYE to secure loans will not suffer, MNS has made considerable conditions on how to recover the loans without affecting the members negatively

4. MNS SUBSIDIARIES

i) Mam

– The board has embarked on the sales of Kisaju houses by reducing the cost . This has been done to ensure that this year 2021 , the SACCO offloads this properties and refocus its energy to the SACCO core business.

ii) Spire bank

The board has already received suitors interested in taking up the majority share holding of the bank , discussions are on going and hopefully the matter will be brought to a close during this year 2021.

iii) MNS risk and Insurance Brokers

It is important to note that this subsidiary doesn’t depend on SACCO support and in the year 2020 it performed well

Before we show you how to calculate dividends its good for you to understand some terminologies used;

Shares: refers to the first KSH 20,000 you contribute to the SACCO

Deposits: refers to any amount contributed above the Ksh 20,000

Read also:

Gusii Mwalimu Sacco, How to calculate dividends 2021

Advantages of Sacco loans over Bank Loans

How to quit membership from Mwalimu Sacco 2021

List of all Saccos in Kenya and their Dividends

Mwalimu Sacco Loans; Mobile loans, BOSA Shares, FOSA savings and Business loans

List of registered and Licenced SACCOS in kenya 2020

List of registered and Licenced SACCOS in kenya 202

For example if you have saved a total of 520,000 it simply means that your shares are 20,000 and your deposits are 500,000

Dividends : refers to the profit earned on the shares and it is usually higher by 1% above the rebate.

Rebate: refers to the profit earned on the deposits and it is usually 1% lower than the dividends rate

Having understood those important terminologies we will now assume that a saver has 20,000 in share capital and 500,000 in deposits

This is how to calculate total dividends and rebates due;

Lets assume the *rate* *of* *dividends* *is* *d*

1.Dividends = 20,000 (share capital )×d/100

2. Rebate (assume the rate is r

a) Deposits as at 31st Dec 2019 were 500,000

So 500,000 ×r/100

b ) Monthly contributions for 2020

Assume a monthly contribution of 5000

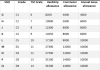

January =5000×r/100×12/12

Feb = 5000×r/100×11/12

March 5000×r/100×10/12

April= 5000×r/100×9/12

May 5000×r/100×8/12

June 5000×r/100 ×7/12

July 5000×r/100×6/12

August 5000 ×r/100×5/12

Sep 5000×r/100×4/12

Oct 5000 ×r/100×3/12

November 5000 ×r/100×2/12

December 5000×r/100×1/12

*Add* *Dividends* + *rebates* *upto* *31st* *dec* *2020* + *all* *monthly* *rebates*

From the total you get, subtract

1Withholding tax 5%

2Ksh 300 dividend processing fee.