Gusii Mwalimu SACCO will start paying Esteemed Members their 2020 dividends as from Monday 22 March, 2021. However, members have found it hard to understand how the amount that was paid as dividends was reached at. Jambo News has dug deep to unearth the formula used by the sacco.

Gusii Mwalimu Sacco decided to calculate dividends of members at montly level. This means that contribution made at the month of January accrued more dividends compared to subsequent months.

In statement, management of the sacco, encouraged members to use M-banking, Sacco-link and ATM channels to access cash. This will help in minimizing crowding in banking hall as much as possible.

“In compliance with M.O.H guidelines on covid-19 management, you are encouraged to use M-banking, Sacco-link and ATM channels to access cash. Avoid crowding banking hall as much as possible,” read part of the statement.

How Gusii Mwalimu Sacco Calculated 2020 Dividends

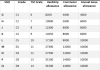

It is important to note that dividends are paid at two levels of percentages; 13% of capital shares that is usually 20,000 for each member and 12% of the amount of shares.

Suppose the rebates on deposits of a member as at December 2019 is Kes. 100,000, capital shares at ksh 20,000 and he/she contributes Kes. 5,000 monthly, the total dividends will be calculated as follow:

HOW TO CALCULATE FOR DIVIDENDS AMOUNT IN KSHS

12% of 100,000(Shares as at December 2018) 12,000

13% of 20,000(Capital shares) 2,600

12% of 5,000(January Contribution) 600

12% of 5,000 x 11/12(February contribution) 550

12% of 5,000 x 10/12(January contribution) 500

12% of 5,000 x 9/12(March contribution) 450

12% of 5,000 x 8/12(April contribution) 400

12% of 5,000 x 7/12(May contribution) 350

12% of 5,000 x 6/12(June contribution) 300

12% of 5,000 x 5/12(July contribution) 300

12% of 5,000 x 4/12(August contribution) 250

12% of 5,000 x 3/12(September contribution) 200

12% of 5,000 x 2/12(October contribution) 150

12% of 5,000 x 1/12(November contribution) 100

TOTAL 18,750

5% of 18, 750 ( Withdrawal Tax) 937.5

AMOUNT RECEIVED AS DIVIDENDS (18,750-937.5) 17,812.50

Note that dividends is subject to the following deductions:

Read also:

Gusii Mwalimu Sacco, How to calculate dividends 2021

Advantages of Sacco loans over Bank Loans

How to quit membership from Mwalimu Sacco 2021

List of all Saccos in Kenya and their Dividends

Mwalimu Sacco Loans; Mobile loans, BOSA Shares, FOSA savings and Business loans

List of registered and Licenced SACCOS in kenya 2020

List of registered and Licenced SACCOS in kenya 2021

Excise duty

Processing fee

Amount expected in your account (net) is the Actual amount (as Calculated above) minus any advance amount taken.

According to one of Gusii Mwalimu Sacco delegates who sought anonymity, the method above was reached in a bid to encourage members to start saving as early as January.

Members who make huge deposits close to the end of the year won’t reap big as per their expectations.