Central Bank says no cause for alarm over banknotes supply

There is enough supply of banknotes in the market despite the suspension of local operations by British currency printing firm De La Rue, the Central Bank of Kenya (CBK) has said.

CBK Governor Patrick Njoroge said on Tuesday that the decision by De La Rue to stop printing notes in Kenya for a year will not affect the supply as the country’s currency needs are “completely fulfilled.”

De La Rue, which operates from Nairobi’s Ruaraka area, designs and produces banknotes and banknote security features for CBK.

The firm retained a Sh10 billion-a-year tender to print Kenya’s new-look currency notes and coins in 2018, which paved way for the retirement of the Sh1,000 older generation notes.

“The impact it has is only to the extent that there are people that work in Kenya supporting that industry,” said Dr Njoroge in response to queries by The Standard during a post-Monetary Policy Committee briefing with journalists. “But in terms of our currency needs (they) are completely fulfilled.”

Sparked jitters

De La Rue announced on January 20 it has suspended its printing operations in Kenya citing reduced orders and a poor economic climate.

The shock move announced by the UK-based firm sparked jitters among hundreds of its local employees and concerns over the supply of the country’s cash and coins requirements.

It said it was exploring business opportunities with a view to restarting production “if the economic climate permits.”

“Owing to current global market demand, and no expectation of new banknote orders from the Central Bank of Kenya for at least the next 12 months, De La Rue Kenya has suspended banknote printing operations in the country,” the company said in a notice to investors.

“Importantly, the joint venture between De La Rue and the Government of Kenya remains active, and the firm continues to explore further business opportunities, both in Kenya and for export from Kenya, with a view to restarting production if the economic climate permits.”

The UK firm employs 300 workers at its Ruaraka factory directly and a further 3,000 indirectly.

It has had a stranglehold on Kenya’s lucrative money printing business except for the period between 1966 and 1985 when another UK firm, Bradbury Wilkinson, did the job.

De La Rue has also been expanding its Nairobi facility to become a regional hub for East Africa. It also works in close partnership with the Kenyan authorities on the delivery of the country’s passport.

“Currently employing in the region of 300 local people, De La Rue has contributed extensively to the local economy over the last two decades through factory investment, the payment of taxes, wages and local purchases,” the company says on its website.

The announcement of halting its Kenya operations came barely a week after the UK firm suffered a major financial blow after the High Court ordered De La Rue to pay Kenya Revenue Authority (KRA) Sh1.1 billion from a long-running tax dispute with the taxman.

The company addressed the legal fight with KRA in its update to investors.

De La Rue said it was disappointed with the ruling, and added that its Kenyan subsidiary was preparing a further appeal.

“On 13 January 2023, the High Court in Nairobi, Kenya dismissed an appeal from a De La Rue subsidiary in Kenya related to a historical tax issue, equating to approximately £7.2 million at today’s exchange rate.

“De La Rue is disappointed with the ruling and its Kenya subsidiary is preparing an appeal to the Court of Appeal,” said De La Rue.

Tax tribunal

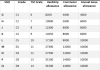

The recent High Court ruling upheld the 2021 judgment of the Tax Tribunal ordering the firm to pay historical taxes due for the years 2013–2017.

De La Rue operates in the country through a joint venture with the Kenya government, which holds a 40 per cent equity share.

The company, however, said the joint venture remains active. The suspension of activities came slightly over a decade after De La Rue threatened to stop local currency printing operations in the country if negotiations for a joint venture with the government failed.

It also threatened at the time to pull out of Kenya, saying there were other countries willing to sign long-term investment deals with it.

De La Rue at the time was referring to stalled joint venture talk days after the firm faced criticism over its local operations.