Money lending process is common mostly to enhance developed and help entrepreneurs to obtain enough capital for their starting business. When one does not manage to pay back the cash to these companies at the required period of time, the penalties rise, interest increases and they are all build on your account. Hence the companies can report you to CRB.

After being reported, you will not be able to access any loan in any company as you are not legible. It takes takes a process to get off the CRB. And some charges do apply.

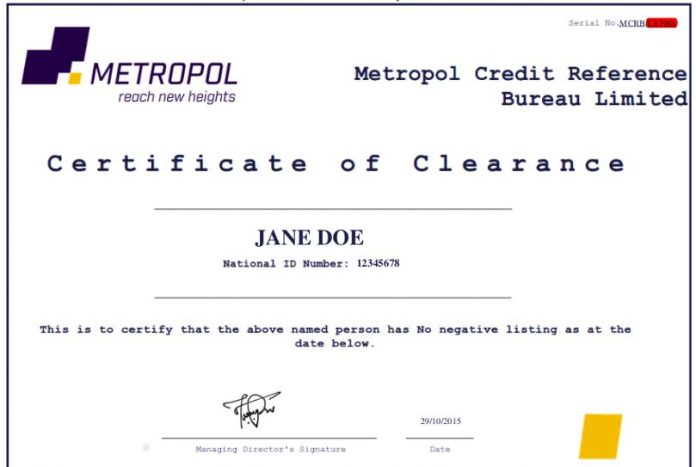

There are three licenced CRB companies and they include; TransUnion, Metropol and CreditInfo.

The Kenyan law permits lenders to submit names of individuals with any non performing loans to credit reference Bureaus for blacklisting. Its brilliant to always service your loans to the final step.

To access your CRB status,register with one or all of the companies .Its possible a lender to send the same bad report to all CRB companies.

Access Meteopol through: The Metropol Website,metropol crystalbol of dial *433#

STEPS.:

Pay 50 Kenyan shillings through 220338.

Get an SMS with a unique pin details,reference number,and a link.

Access metropol CRB services.

After paying fifty shillings you are allowed to check status.

You can also visit Metropal web,Login, and view your status.

After payment of the required fees you will follow the same steps as for checking your CRB status above.

Pay all the fees same way you paid registration money.For credit score, pay kes 150..

You are entitled to one fee credit report in one year. Metropal gives you a score between 200 and 900. Scores below 400 will mean you are a defaulter and lenders cannot offer you with loans.

Any score above 400 will mean fair and lenders will give you loans with caution. Good credit score should be 900 and the lenders will offer you cheap loans.

Credit report, pay 250 Kenyan shillings.This is detailed report on how you interact with financial institutions

To know who listed you, pay kes 50. For a clearance certificate sh.2200 is required. After clearing your loans, you’ll be issued with the certificate to affirm that you are legible to be given other loans.

when you have full settled your credit scores,of takes one to two days for your new new CRB scores to reflect on CRB.