Zenka loan apk/ app download:

Zenka loan app is the latest Kenya’s microloan lending app developed by Zenka Kenya. The app currently offers personal loans which range from Ksh 500 to Ksh 20,000 on android smartphone and Ksh 500 to Ksh 10,000 via USSD.

The best thing about the Zenka loan app is that the first loan is interest-free. That is to say; if you borrow Ksh 500 for the first time, you will repay the same amount.

In addition to that, you get to access and borrow a Zenka loan without using a smartphone. So, we have carefully reviewed the app, and we can say with much confidence that it is the best loan app next to Tala loan.

USSD CODE

If you do not own a smartphone to download its android or iphone app, you can also try accessing Zenka services by dialing *841# or *483*101#

What are the zenka loan requirements and illegibility:

To be able to use the Zenka app, one needs to own a phone, be at least 18 years with a valid national ID and also be a registered Safaricom subscriber.

In addition, users must also grant the app permission to access your phone data in order to further ascertain the user’s eligibility.

How to download and install Zenka Loan App Guide:

The installation process is simple, like that of any other app. Go to your phone’s app store. If you’re on Android, here’s the procedure:

- Go to Google Play and search for Zenka Loan App – Kenya.

- Choose the app by Zenka Finance Limited.

- Click on Install.

- Let the installation process finish before going to the registration process.

If you’re on an iOS device like an iPhone, here’s how to download the Zenka Loan App for quick mobile loans.

- Launch App Store on your phone.

- Search for Zenka Loan – Kenya.

- Tap on the first app with a yellowish logo.

- Confirm it is by Zenka Finance Limited.

- Tap Get and allow it to install.

The installation process is as easy as that. But in order to get a loan, you must provide a few important details. I have explained that below.

How to register with zenka loan:

once you’ve downloaded and installed the Zenka App, kindly follow these steps:

1. Start the application,

2. Choose your loan amount and term on the sliders,

3. Click on “Apply for loan”,

4. On the next screen please click on “Sign up”,

5. Enter:

- Your first name

- Your last name

- your national ID

- Education level

- Source of income

- Net monthly income

- Select a security question

- Answer to the security question

6. Enter a 4-digit PIN number,

7. Input the code EK6P

8. Click on “Agree and sign up” and you will receive an SMS with a 4-digit verification code,

10. Check if the code is auto filled or Input the code and click “Done”.

Please note that your phone data will be considered during loan disbursements. In the event that your application is not successful the first time, kindly maintain the app installed on your phone as you gradually accumulate enough data on your phone and attempt to reapply in future.

What are zenka LOAN AMOUNTS and limits?

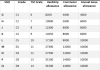

Zenka loan amounts range from Ksh 500 to a maximum of Ksh 20,000 with loan increments being dependent on historical timely Zenka loan repayments.

What are the Zenka loan interest rates:

Zenka charges an interest rate of 29%

REPAYMENT DURATION

The repayment terms range between 1-30 days.

How to repay zenka loans;

To repay your loan, please kindly follow these steps:

1. Start the application,

2. Scroll down and click on “Repay”,

3. Select or edit the default repayment amount (open amount),

4. Click on “Repay now” and follow the Payment Link.

APP PERMISSIONS

Zenka uses state-of-the-art encryption techniques to make sure your data is always 100% secure. Your data is never shared with or sold to third parties, unless for specific reasons like reporting to authorized Credit Bureaus.

This app has access to:

-

Identity- find accounts on the device

-

Device ID & call information- read phone status and identity

-

Phone- read phone status and identity and directly call phone numbers

-

Contacts- read your contacts and find accounts on the device

-

SMS- read your text messages (SMS or MMS)

-

Wi-Fi connection information- view Wi-Fi connections

-

Location- approximate location (network-based) and precise location (GPS and network-based)

Other

-

Receive data from Internet

-

View network connections

-

Full network access

-

Prevent device from sleeping

-

Connect and disconnect from Wi-Fi

-

Pair with Bluetooth devices

What’s the penalts for ; LATE REPAYMENTS

A penalty fee of 1% per day is charged on any outstanding amount not repaid after the due date.

OVER PAYMENTS

REPAYMENT DATE EXTENSION

Zenka offers extensions at different fees depending on the duration i.e 15% ( 7 day extension ) , 22% ( 14 day extension ) and 29% ( 30 day extension )

Zenka loan contacts and details;

-

Email- support@zenka.co.ke

-

Official Website- https://zenka.co.ke/

-

Facebook- https://www.facebook.com/zenkakenya/

-

Twitter- https://twitter.com/zenkafinance

What’s zenka’s paybill number?

- Zenka Paybill Number is 979988

- Enter your phone number as the account number

Note: Normal M-Pesa Rates and charges for pay bill apply.

Zenka Loan Application Tips for Approval

There are a few basics you can follow for fast approval of your mobile loan application. There are quite many loan apps in Kenya including Pezesha, Tala, Stawi, Haraka, and many many more.

Some of these apps may have already blacklisted you or denied you a loan because of something you did. Here are important tips for getting a Zenka loan approved easily and fast.

- Make sure your name is cleared by Kenya’s credit reference bureaus. Zenka works with 3 of these in Kenya, including Metropol, TransUnion and CreditInfo. If you’re listed here, you may not be approved for a loan on most loan apps in Kenya.

- Use a device that has never been used before to apply for a loan from Zenka. Mobile loan companies store device information and associate them with the first registrant.

- Build your credit score by paying your loan on time. This builds confidence, giving you access to higher loan amounts of up to Ksh. 20,000 on this app.

- Ensure you allow access to your data when installing and registering. This allows the app to access vital information about you.

These tips are important if you want a fast loan without collateral.

Does Zenka Have a Referral Program?

According to the app, you can earn Ksh. 200 when you invite friends. The qualification, however, is that you earn the credit whenever they repay their first loan on the app.

You’re given a promo code you can use to invite friends with. Once they use the promo code to sign up and request a loan, you become eligible on their referral rewards program. You could earn Ksh. 200 when they repay the loan.

This was a fun article to write! Check out these secret menu items in Dallas restaurants.

… http://yorkstreetdallas.com

Everything is very open with a precise edplanation of the issues.

It was really informative. Your website is

very useful. Thanks for sharing!

Huh…thanks for the appreciation