Haraka Loan is offered by GetBucks finance.

To contact Haraka , you can: –

- Email; kenyaharaka@getbucks.com

- Call; 0770637594

- Facebook; fb.me/getbuckskenya2

Products and services.

- Haraka Loans.

How to Access Haraka Facilities

You can access Haraka facilities via mobile apps.

Haraka loan Apps are available for download on their website –https://haraka-app.com/

If you don’t have a smartphone or active internet, you can access Haraka loans by dialing the USSD code *841# on your phone and follow the prompts.

Loan Process.

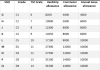

The minimum loan amount you can get from Haraka is ksh 250 while the maximum amount is ksh 5,000.

How to borrow a loan fromHaraka.

To borrow a loan from Haraka , you must have the following;

All you need is to sign up using your Facebook account and apply for a loan.

To get a loan from Haraka by smartphone users;

- Download the Application from the website – https://haraka-app.com/

- Create an account using your Facebook profile.

- Choose your loan amount and payment terms.

- Receive your cash in your mobile wallet in minutes.

How to get loans from Haraka by Feature Phone (kabambe) or non smartphone users;

If you do not have internet access but wish to borrow a loan from Haraka you can also use the following process.

- Dial the USSD code *841# and follow the prompts.

- This service can only be accessed by Safaricom subscribers.

How fast you can you borrrow from Haraka .

Once approved, you will have the loan sent to your mobile wallet in minutes.

How to pay back your Haraka mobile loans.

There are two ways to clear your loan;

You can pay back via Mpesa, using Haraka paybill number 817910 and your phone number as your M-Pesa account number.

Alternatively, pay your Haraka loan via the steps highlighted below.

- Dial the USSD Code *841#,

- Enter your 4-digit PIN,

- Select [Repay] and find the information about your current balance.

- Select [Repay full amount] and follow the payment link.

Haraka Loan terms and conditions.

- All Haraka loans attract a 23% interest rate.

- The repayment period can be between 7-30 days.

- You are rewarded by higher loan limits for paying your loans on time.

What is unique about Haraka Mobile Loans.

- Branch free – No need to travel to a branch, simply apply on your mobile phone.

- Bank free – Cash is deposited into your mobile wallet.

- All over access – Accessible in remote areas.

- Rewards – Get access to benefits with good repayment behavior

Wahu