Tala is a mobile-based financial lending service that operates through the internet. The service is accessible through the Tala loan application, which is available on smartphones and other smart devices. To start using the service, you simply need to download the app to your phone, complete the registration process, and apply for a loan. If you are eligible, the money is deposited to your mobile money account. Currently, the service only works with M-Pesa.

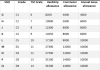

The loans that are offered vary depending on your M-Pesa transaction history. The app will usually scan your phone’s M-Pesa messages to find this history. Usually, the starting amount will be around KES 500 or higher. However, over time, you can grow the amount up to KES 50,000. To get access to more funds, you need to increase your usage of the service, make early repayments, and complete multiple M-Pesa transactions.

Tala loans are unsecured, meaning that you are not required to provide security or a guarantor. However, as a result, the repayment periods are shorter than those of standard financial institutions (current repayment periods of 30-days or 21-days). The loans also attract an “interest rate” which the company refers to as a service fee. Current service fees are 15% for 21 days and 11% for 30 days.

To access the service, you need an internet-enabled device such as a smartphone or tablet and the Tala loan app.

Tala loan app download for Android

For Android phones and devices, the Tala loan apk is available on Google Play Store. Follow this Tala loan app download process for Android devices:

- Go to Google Play Store on your Android phone or device

- Search for and install the app

- Register for an account – you will need an activated M-Pesa line for this. Other personal details will also be required, such as full names and a national ID/passport number.

The application process is simple. These tips show how you can go about getting your first and subsequent loan.

- Once have completed the Tala loan app download and registered, login into your Tala account. The app will scour through your phone’s message for M-Pesa transaction history to determine how much money you are eligible for. This process will only take a few minutes.

- Go to the “Apply Now” section. Answer the questions asked. For example, the reason for the loan, outstanding loans, among others. Once you are done, the amount you are eligible for will be displayed.

- Choose the repayment period. Options are normally 30-days in one installment or 21-days in three (weekly) installments.

- Click “Send My Loan” to have the money sent to your M-Pesa line. It is sent almost instantly. In most cases, it is usually within a few minutes.r, applying for a loan online is not a guarantee that you will get one. There are several factors that can lead you to not getting approved or getting a smaller amount. These include:

- If you have outstanding Tala loans (for existing users) – you must first repay the current one before getting another.

- If you were late in repaying your previous loan

- If you have outstanding loans with other financial services

- If you have defaulted on your loan – the service checks on the CRB (Credit Reference Bureau), Kenya’s database of defaulters.

- If your M-Pesa transaction history doesn’t meet the requirements for awarding a loan.

Withdrawing your Tala loan

A Tala loan is deposited into your M-Pesa account, not your Tala account. Therefore, once you are approved, you will get immediate access to your money. From the M-Pesa account, you can withdraw the money from an M-Pesa agent or an ATM.

Tala loan repayment

Tala loan repayment is also quite simple, just like the registration and application process. To repay your loan:

- Go to the Sim Tool Kit app on your phone and choose the M-Pesa service

- On the M-Pesa menu, select the “Lipa Na M-Pesa” option and then choose “Paybill”.

- Enter Tala’s paybill number 851900

- Enter your M-Pesa number (one used to register Tala) as the account number

- Review the money transfer request and submit it to send the payment. In a short while, a payment sent message (from M-Pesa) and payment received message (from Inventure) will be sent to your phone number. The payment will also reflect on your Tala account, allowing you to apply for another loan.

Tala app contacts

When experiencing problems while using the app, use the following details:

Email: hellokenya@talamobile.com

Facebook: @TalaKenya

Twitter: @TalaKenya

If you are looking for a quick and reliable solution to your current financial woes, the Tala loan app can help you to get instant cash to sort out your urgent financial needs, including emergency expenses, business expenses, and personal expenses. The best part is, you do not require any loan security. Simply download the Tala app, register an account, and apply for your first loan. Hopefully, this Tala loan app download guide has helped you get and install the app on your device.