The Kenya Revenue authority has now revealed that Kenyans will have to wait a little bit longer for the tax reductions announced by President Uhuru Kenyatta they say its because the bill will have to become law for it to take effect.

Hence Public Workers will not get tax cuts until proposed amendments become law. The announcement by the president has raised hopes for the past days as they expected their pay on this month, April to be abit high. To help them manage themselves at these hard times.

“Please note the PAYE rate is now a bill that is yet to be assented to. Use the old rates until such a time when Parliament will pass the bill into law,” KRA said in tweet.

This was in an answer to a Twitter user who was seeking clarification on whether to use the rates that were proposed by President Kenyatta in preparing salaries for April.

In the proposed tax cuts, which Parliament is debating, workers earning less than Sh24, 000 will be excluded from paying taxes while the minimum income tax rate, known as Pay-As-You-Earn (PAYE) has been reduced from 30 to 25 percent.

Hence the workers are urged to wait for it to be law. “We urge Kenyans to use the previous rates till further communication,” KRA stated.

During his press briefing, the president noted that the tax reductions would take effect from Wednesday, April 1, but KRA explained why this is yet to happen.

“Yes, it was from April 1, as he had announced but that was a proposal, for instance, he announced the reduction of VAT from 16 to 14% that one was with immediate effect enacted into law, it was gazetted actually.

“For PAYE it was a proposal that has to be deliberated by Parliament which happens with everything that the president says regarding taxation,” the taxman explained.

KRA stated that as Pariament was in session on Wednesday, April 22, once the bill becomes law the reductions would be adopted.

On the issue of filing tax returns, KRA noted that no deadline extension was expected.

“That one is still within the six months, from January to June 30th. We highly doubt that there will be an extension because that is the law.”

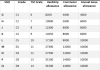

“Reforms have been introduced in the Pay-As-You-Earn by: the personal relief has been enhanced by around Ksh. 992 per month, from the current Ksh. 1408 to Ksh. 2400.

“Secondly, person’s earning below Ksh24,000 have been exempted from paying PAYE. Third, the PAYE as well as pension taxation bands have been reduced from 5 to 4.”

Thanks for reading our article. Subscribe for more news immediately we post.