EUSE THESE STEPS TO ESCAPE FROM KRA PENALTIES MESSAGE FROM KENYA REVENUE AUTHORITY (KRA) TO ALL KENYANS.

YOUR RETURN BEFORE 30/06/2022″

How to file nil returns on the KRA iTax portal the right way Read more:

1. How To File KRA Nil Returns In 2022

It is important that if you have an active KRA PIN on iTax, you should ensure that you file your KRA Returns each and every year between 1st January to 30th June. This dates are very important to note down is you want to part of the tax compliant Kenyans. The deadline this year for file KRA Nil Returns is 30th June 2022.

The Tax Procedures Act states that if a return is not submitted by the respective due date a penalty will be imposed. Avoid getting penalties from Kenya Revenue Authority (KRA) and file your KRA Nil Returns online today with ease and convenience.

Requirements Needed For Filing KRA Nil Returns In 2022

To be able to file your KRA Nil Returns on iTax, you need to ensure that you have with you KRA PIN Number and KRA iTax Password. Before we get started on the various steps, you need to ensure that you have the following two items with you:

- Your KRA PIN Number

- Your KRA iTax Password

For you to able to file your KRA Nil Returns on KRA iTax Web Portal, you need to ensure that you have with you two key requirements i.e KRA PIN Number and KRA iTax Password. We are going to look at each of these KRA Nil Returns requirements in brief details below.

KRA PIN Number

KRA PIN Number is the most important requirement that you need to have with you. If by any chance you have forgotten or you don’t remember your KRA PIN, you can submit KRA PIN Retrieval order online here at KRA Portal and our team of experts will be able to assist with with PIN Retrieval request.

At the same time, if you are looking for a new KRA PIN, you can get it here in 3 minutes by submitting your KRA PIN Registration order today at Cyber.co.ke Portal. Your KRA PIN Certificate will be sent to your Email Address once the Request for PIN Registration has been done and processed from our Support team.

iTax Password

The next requirement that you need to have with you is your KRA iTax Password. You will need the iTax Password to access your KRA iTax Account. If you don’t know or have forgotten your iTax Password, you can check our article on How To Reset KRA iTax Password. Once you have requested for password reset, a new password will be emailed to you and you can use it to log into your iTax Account.

You can only change or reset your iTax Password if the email used in KRA iTax Portal is the same that you currently have. If you don’t remember or need to change your KRA Email Address, you can submit KRA PIN Change of Email Address

NOTE 1: If you don’t remember (forgotten) your KRA PIN and would like to retrieve it today, you can still get it through portal at: KRA PIN Retrieval.

2. How to file Income Tax Employment Income by yourself.

GO TO ITAX Open your browser and go to https://itax.kra.go.ke/KRA-Portal/

LOGIN Enter your KRA PIN, click Continue. Enter Password and Security Stamp ( answer to arithmetic sum) and Click Log In

GO TO RETURNS MENU Go to Returns Menu and select ITR For Employment Income Only

ENTER RETURN PERIOD Enter Return Period, select ‘Yes’ to the question ‘Do you have employment income?’ and Click ‘Next’

FILL IN RETURN INFORMATION Under basic information, answer the questions asked appropriately and Click ‘Next’

CONFIRM DETAILS OF EMPLOYMENT INCOME Go to Section F, details of employment income and confirm the name and PIN of employer, Gross Pay and other allowances as per your P9 form.

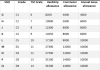

CONFIRM DETAILS OF PAYE DEDUCTED Go to Sheet M, details of PAYE deducted, confirm Employer details, Taxable salary, chargeable pay, Tax payable on taxable salary and PAYE deducted. Details can be modified as per your P9.

ENTER DETAILS OF INCOME TAX PAID IN ADVANCE Go to Section Q and capture a payment if any, made prior to the filing of the return

TAX COMPUTATION Go to Section T, Tax Computation, Enter defined/pension contribution amount (as per your P9 actual contribution by employee) and personal relief. Click ‘Submit’ and download the E-return acknowledgment receipt