Overpayment shall be computed as gross earnings less statutory deductions where applicable and not on net pay. It may occur in any of the following incidences:

1. Absence

Overpayment shall be computed as basic salary for the number of days the employee is absent. There shall be no reductions with any statutory deduction.

2. Desertion

Overpayment shall be computed as basic salary plus all allowances less statutory deductions to give the net overpayment.

3. Exits from Service

An overpayment may occur if an employee remains on payroll after the date of exit from service due to resignation, transfer of service, dismissal or retirement. An overpayment shall be recorded as basic salary plus allowances less statutory deductions.

(a) Resignation

If an employee resigns while on probation, s/he shall be give seven (7) days’ notice or pay equivalent of seven (7) days’ salary in lieu of notice.

If an employee resigns after probation, one (1) months’ notice shall be given in writing or payment of one (1) month’s salary in lieu of notice.

(b) Transfer of service

Any employee who is offered employment in the public service shall be required to submit the following documents:

An application in writing.

A copy of the appointment letter.

A clearance certificate.

Upon submission of the above requirements, the Commission shall issue last pay certificate and a formal release letter.

(c) Retirement

Salary overpayment may occur if an employee remains on payroll after compulsory retirement. It is recorded as basic salary plus allowances less statutory deductions.

Any employee who may wish to retire voluntarily from service shall be required to give three months’ notice in writing or pay one month’s salary in lieu of notice.

(d) Death

A salary overpayment may occur if a teacher remains on payroll after death. It and shall be computed from the next day after the date of death until date of removal from payroll. However, the house allowance for the month of death shall be paid in full.

(e) Economic Crimes and other serious offences

Any employee who is confined in lawful custody shall not be entitled to any payment during that period.

However, after being charged with the offence in the court of law, s/he shall be suspended from work from the date they were charged and shall be entitled to half (½) basic salary, medical allowance and house allowance.

Any overpayment that occurs during this period shall be computed if an employee is on payroll on full salary after the date of the charge.

(f) Professional Misconduct

This includes but is not restricted to negligence of duty, insubordination, infamous conduct and exam irregularities.

Once an employee has been interdicted for any of these offences, s/he is entitled to half (½) basic salary plus house allowance until the determination of the case.

Any overpayment that occurs shall be computed if an employee is paid full pay during the period of interdiction.

(g) Other offences

These include but not restricted to immoral behaviour, misappropriation or mismanagement of funds, use of fake certificates, forgery, impersonation, collusion and chronic absenteeism. Any employee interdicted for these offences shall not be entitled to any pay hence put on zero salary.

Any overpayment that occurs if an employee remains on payroll after the interdiction date shall be computed on full basic salary plus all allowances less statutory deductions.

4. Leave

The Commission may grant different types of leave to its employees that include annual leave, sick leave, study leave, special leave, compassionate leave, maternity and paternity leave.

An overpayment may occur if an employee remains on payroll after failing to report back for assignment of duties upon expiry of the specified leave.

This overpayment shall be computed as basic salary plus allowances less statutory deductions.

(a) Sick leave

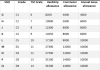

In a case where an employee is on a prolonged sickness, the sick leave shall be granted as follows:

First three (3) months the employee to granted full pay,

Next three (3) months the employee to be granted ½ basic salary with full allowances,

After six (6) months the employee to be granted sick leave without pay until resumption date.

An overpayment shall be computed where the above conditions are not adhered to.

(b) Study leave without pay

Salary overpayment may occur if an employee remains on payroll after proceeding on unpaid study leave.

Such an overpayment shall be computed on basic salary plus all allowances from the date the teacher stops teaching until date of removal from the payroll.