Here is an updated list of the best instant mobile loan apps in Kenya as of 2020. We all know that it is not that easy to qualify for a loan in Kenya most especially from banks. Mobile credit lending has been revolutionized since the pioneering launch of M Shwari on November 2012 which was a partnership between Safaricom and Commercial Bank of Africa (CBA ).

Almost everyone on the Safaricom network who had an active MPESA account had access to the service since it needed no prior installations of any kind.

Fast forward to 2020 and the sector has been overrun by various providers all competing for the ever-growing demand base for quick and short-term mobile loans. Despite a large number of said providers, satisfactory service is still at stake with sections offering high-interest rates, low repayment periods, registration fees, poor app development etc

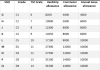

Below is a ranked list of the top 10 best mobile lending apps as of January 2020 based on ratings, reviews and downloads available on the Google Playstore.

The parameters used are:

– Ratings of 3.9+

– Reviews of 6K+

– Downloads of 100K+

So in-order for a lender to qualify for the list, they should meet ALL the above mentioned parameters.

1. Tala

This is the most popular loan service released on Mar 16, 2014 provided by Tala Mobile. It currently has a 4.7 star rating with 346K+ reviews and 5M+ downloads. They offer loan amounts ranging from KES 500 to KES 30,000 with flexible interest rates depending on the repayment duration. The interest rate fee charged for 21 days is 11% while for 30 days is 15%.

The app can be downloaded via https://tinyurl.com/o2qlgsp

2. Branch

Branch was released on Mar 19, 2015 by Branch International. It currently has a 4.7 star rating with 186K+ reviews and 5M+ downloads. Their loan amounts range is from KES 250 to KES 70,000 at interest rates of between 13% to 29%. They also offer a repayment period of 21 days and 30 days.

The app is available at https://tinyurl.com/y2bwbzt2

3. Timiza

Timiza loan service is offered by Barclays and was released on Mar 15, 2018. It has a 4.2 star rating with 10K+ reviews with 1M+ downloads. It offers loan amounts from as little as KES 50 to a maximum of KES 150,000. Their interest rates are capped at 6.08% and repayment duration is usually 30 days.

One can download the app viahttps://tinyurl.com/y8w3veeh

4. Zenka

Zenka is a fairly new service but has managed to make it at number 4. It is offered by Zenka Finance and was released on Nov 13, 2018. It holds a 4.2 star rating with 10K+ reviews and 500K+ downloads. It offers loan amounts ranging from KES 500 to KES 20,000. It has an interest rate fee of 29% repayable after 30 days.

The app can be downloaded via https://bit.ly/2UXDSf2

5. Okash

Okash was released on Feb 1, 2018 by OneSpot Technology Ltd. Since then it has garnered a 4.1 star rating with 45K review and 1M+ downloads.The least amount one can borrow is KES 2,500 while the highest is KES 50,000. It’s interest rates are dependent on the repayment period whereby the interest rate is 14% for 14 days ) and 16.8% for 21 days.

The app is available throughhttps://bit.ly/2XBjDks

6. Opesa

Opesa was officially released on Dec 6, 2018 by TK Ltd. It currently sits on a 4.1 star rating with 14K reviews and 1M+ downloads. They offer loan amounts of between KES 2,000 to KES 10,000 at 16.8% fee with a repayable period is 14 days.

The app is downloadable at https://tinyurl.com/yyoqep3c

7. Stawika

Stawika was released on Jun 6, 2018 by a company called Stawika Capital Ltd. It has a 4.1 star rating with 13K+ reviews and 500K+ downloads. It provides loans of between KES 500 to KES 50,000 at an interest rate of 1% per day for 21 days.

The app is available athttps://tinyurl.com/y5rtvro2

8. Haraka

Haraka is a Aug 24, 2014 release offered by Getbucks Pty ( Ltd ).The app has a 4.1 star rating with 11K reviews and 500K+ downloads. Their loan amounts range from KES 500 to KES 50,000at an interest rate of 23.45% payable after 30 days.

The app can be downloaded viahttps://bit.ly/2NMrQS3

9. Saida

Saida was released on Mar 17, 2015 by Greenshoe Capital INC. It holds a star rating of 4.0 with 9K+ reviews and 500K+ downloads. They offer a minimum amount of KES 600 to a maximum of KES 100,000. Their interest rate is highest at 15% but fluctuates according to one’s loan repayments and increasing loan limits. The loans are repayable after 30 days.

The app can be downloaded at https://tinyurl.com/pb8vrwo

10. Okolea

Our finalist for tenth spot is Okolea. It is a loan service offered by Okolea International released on Mar 22, 2017. It has a 3.9 star rating with 6K+ reviews and 100K+ downloads. Its loan range is between KES 500 to KES 50,000 at flexible interest rates dependent on repayment duration. I.e Interest rate is 5% ( 2 days ) , 8% ( 7 days ) , 11% ( 14 days ) , 13% ( 21 days ) and 15% ( 30 days )

It can be downloaded at https://tinyurl.com/y65ectz